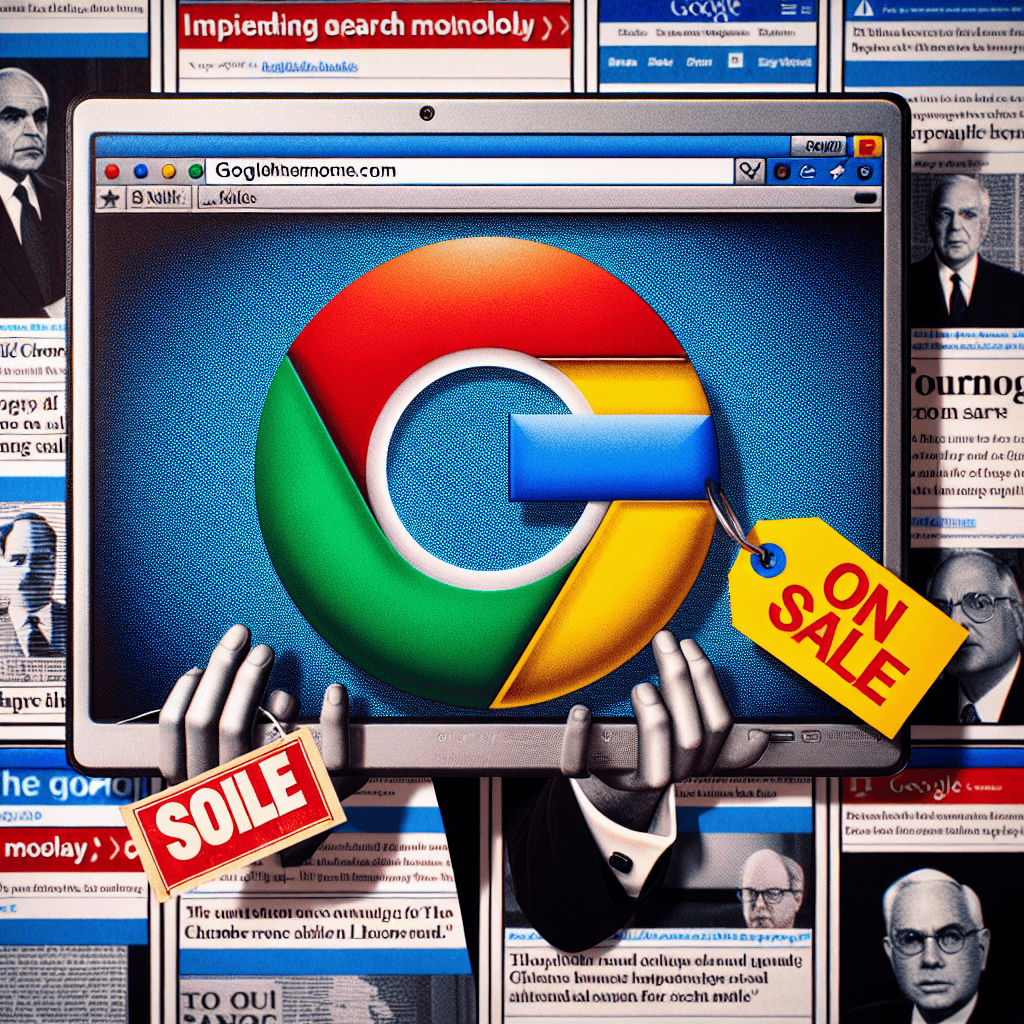

In a significant development within the tech industry, Google may face the prospect of divesting its Chrome browser to address antitrust concerns related to its dominance in the search engine market. This potential move comes amid increasing scrutiny from regulatory bodies worldwide, which are examining the company’s practices to ensure fair competition. The core of the issue lies in Google’s integration of its search engine with the Chrome browser, a combination that critics argue stifles competition and reinforces its monopoly in online search. As regulators push for measures to dismantle perceived anti-competitive practices, the possibility of Google being compelled to sell Chrome underscores the growing pressure on tech giants to adapt to evolving legal and market landscapes. This situation not only highlights the challenges faced by dominant players in maintaining their market positions but also signals a broader shift towards ensuring a more competitive digital ecosystem.

Impact Of A Chrome Sale On Google’s Market Dominance

The potential divestiture of Google’s Chrome browser as a result of antitrust scrutiny could significantly alter the landscape of the tech giant’s market dominance. As regulatory bodies intensify their examination of Google’s business practices, the possibility of a forced sale of Chrome emerges as a pivotal moment in the ongoing debate over monopolistic behavior in the digital age. This development raises critical questions about the future of Google’s influence in the tech industry and the broader implications for competition and innovation.

Google’s Chrome browser, launched in 2008, quickly ascended to become the world’s most popular web browser, capturing a substantial share of the market. Its integration with Google’s search engine and other services has been a cornerstone of the company’s strategy to maintain its dominance in the digital ecosystem. However, this integration has also drawn the attention of regulators who argue that it stifles competition and limits consumer choice. The potential sale of Chrome would not only disrupt Google’s business model but also reshape the competitive dynamics of the browser market.

If Google were compelled to divest Chrome, the immediate impact would be a significant reduction in its ability to leverage the browser to promote its search engine and other services. This separation could lead to a more level playing field, allowing rival browsers and search engines to gain traction and compete more effectively. Consequently, consumers might benefit from increased innovation and diversity in the browser market, as companies strive to differentiate their offerings and capture user interest.

Moreover, the sale of Chrome could have far-reaching implications for Google’s advertising business, which relies heavily on data collected through its browser. Without direct control over Chrome, Google might face challenges in maintaining its current level of data collection and user tracking, potentially diminishing its advertising revenue. This shift could prompt Google to explore new avenues for data acquisition and advertising strategies, potentially leading to a more privacy-focused approach that aligns with growing consumer concerns about data security.

In addition to affecting Google’s business operations, the divestiture of Chrome could serve as a precedent for future antitrust actions against other tech giants. Regulators worldwide are increasingly scrutinizing the practices of major technology companies, and a successful case against Google could embolden further efforts to dismantle perceived monopolies. This could lead to a wave of regulatory actions aimed at promoting competition and curbing the influence of dominant players in various sectors of the tech industry.

However, the potential sale of Chrome is not without its challenges. Identifying a suitable buyer and ensuring a smooth transition of ownership would be complex tasks, requiring careful consideration of the technical and operational aspects involved. Additionally, the impact on Google’s workforce and corporate culture would need to be managed to minimize disruption and maintain morale.

In conclusion, the prospect of Google being forced to sell Chrome as a result of antitrust rulings represents a significant turning point in the ongoing discourse on market dominance and competition in the tech industry. While the immediate effects on Google’s business model and market position are evident, the broader implications for competition, innovation, and regulatory practices are equally profound. As this situation unfolds, it will be crucial to monitor how these changes influence the digital landscape and shape the future of technology companies worldwide.

Potential Buyers For Google’s Chrome Browser

In the ever-evolving landscape of technology and antitrust regulations, the possibility of Google being compelled to divest its Chrome browser has sparked considerable interest and speculation. As regulatory bodies intensify their scrutiny of tech giants, the potential sale of Chrome could reshape the digital ecosystem. This scenario raises intriguing questions about who might step forward as potential buyers for one of the most widely used web browsers in the world.

To begin with, Microsoft emerges as a prominent contender. With its Edge browser already gaining traction, acquiring Chrome could significantly bolster Microsoft’s position in the browser market. Such a move would not only expand its user base but also enhance its ability to integrate services across its ecosystem, from Windows operating systems to cloud services. Moreover, Microsoft has a history of navigating antitrust challenges, which could make it a suitable candidate to manage the complexities of acquiring a high-profile asset like Chrome.

Another potential buyer could be Apple. Although Apple has traditionally focused on its Safari browser, acquiring Chrome could provide a strategic advantage. By integrating Chrome’s features and user base, Apple could further solidify its influence in the browser market, especially on non-Apple devices. This acquisition could also align with Apple’s emphasis on privacy and security, potentially offering a more secure browsing experience by leveraging Chrome’s infrastructure while adhering to Apple’s stringent privacy standards.

In addition to these tech giants, smaller companies and startups might also express interest in acquiring Chrome. For instance, Mozilla, the organization behind Firefox, could see this as an opportunity to expand its reach and compete more effectively against larger players. By acquiring Chrome, Mozilla could leverage its open-source expertise to innovate and enhance the browser’s capabilities, potentially attracting users who prioritize customization and transparency.

Furthermore, international companies might also enter the fray. For example, Baidu, China’s leading search engine, could view acquiring Chrome as a strategic move to expand its global presence. By integrating Chrome with its existing services, Baidu could enhance its offerings and compete more effectively on the international stage. Similarly, European companies like Opera Software might see this as an opportunity to strengthen their market position and diversify their product portfolio.

While these potential buyers present intriguing possibilities, the sale of Chrome would undoubtedly involve complex negotiations and regulatory considerations. Antitrust authorities would likely scrutinize any acquisition to ensure that it does not create new monopolistic concerns. Consequently, potential buyers would need to demonstrate their ability to maintain a competitive market environment and uphold user privacy and security standards.

In conclusion, the prospect of Google being forced to sell Chrome opens up a realm of possibilities for potential buyers. Whether it is established tech giants like Microsoft and Apple, innovative organizations like Mozilla, or international players like Baidu and Opera Software, each contender brings unique strengths and strategic motivations to the table. As the situation unfolds, the tech industry and consumers alike will be keenly observing how this potential divestiture could reshape the browser landscape and influence the broader dynamics of the digital world.

How A Chrome Divestiture Could Reshape The Browser Market

The potential divestiture of Google Chrome as a result of antitrust scrutiny could significantly reshape the browser market, introducing a new era of competition and innovation. As regulatory bodies worldwide intensify their examination of tech giants, Google finds itself at the center of a debate over its dominance in the search and browser markets. The possibility of being compelled to sell Chrome, its widely used web browser, raises questions about the future landscape of internet browsing and the implications for both consumers and competitors.

To understand the potential impact of such a divestiture, it is essential to consider the current state of the browser market. Google Chrome, since its launch in 2008, has grown to become the most popular web browser globally, commanding a substantial market share. Its integration with Google’s search engine and other services has created a seamless user experience, contributing to its widespread adoption. However, this integration has also raised concerns about Google’s ability to leverage its dominance in search to maintain and expand its browser market share, potentially stifling competition.

If Google were to divest Chrome, the immediate effect would likely be an increase in competition among existing browsers. Competitors such as Mozilla Firefox, Microsoft Edge, and Apple’s Safari could gain market share as users explore alternatives. This shift could encourage these companies to innovate and improve their offerings, leading to a more diverse and dynamic browser ecosystem. Moreover, a divestiture could lower barriers to entry for new players, fostering an environment where smaller companies can introduce novel features and technologies.

In addition to fostering competition, a Chrome divestiture could have significant implications for user privacy and data security. Currently, Google’s business model relies heavily on data collection and targeted advertising, raising concerns about user privacy. An independent Chrome could potentially adopt different privacy practices, aligning more closely with user demands for greater control over their data. This shift could prompt other browsers to enhance their privacy features, ultimately benefiting consumers.

Furthermore, the divestiture could influence the development of web standards and technologies. As a dominant player, Google has had considerable influence over the direction of web standards, often prioritizing features that align with its interests. An independent Chrome might collaborate more openly with other industry stakeholders, leading to more balanced and inclusive development of web technologies. This collaboration could result in a more interoperable and user-friendly web experience.

However, the transition to a post-divestiture market would not be without challenges. The new entity owning Chrome would need to establish its identity and business model, potentially facing financial and operational hurdles. Additionally, users accustomed to the integration of Chrome with Google’s ecosystem might experience disruptions, necessitating adjustments in their browsing habits.

In conclusion, while the prospect of Google being forced to sell Chrome presents uncertainties, it also offers opportunities for a more competitive and innovative browser market. By leveling the playing field, a divestiture could stimulate advancements in browser technology, enhance user privacy, and promote the development of web standards. As regulatory bodies continue to scrutinize the tech industry, the outcome of this potential divestiture will be closely watched, with far-reaching implications for the future of internet browsing.

Legal Precedents For Tech Company Breakups

In recent years, the increasing scrutiny of major technology companies has led to a renewed focus on antitrust laws and their application in the digital age. The potential for Google to be compelled to divest its Chrome browser as a means to mitigate its dominance in the search engine market is a development that echoes historical legal precedents. These precedents have shaped the landscape of corporate regulation, particularly in the technology sector, and provide a framework for understanding the possible outcomes of such a ruling.

Historically, antitrust actions have been employed to dismantle monopolistic structures and promote competitive markets. One of the most notable examples is the breakup of AT&T in the early 1980s. The telecommunications giant was divided into several smaller entities, known as the “Baby Bells,” to foster competition and innovation in the industry. This landmark case set a precedent for how regulators could intervene in markets where a single entity held excessive power, thereby stifling competition and consumer choice.

Similarly, the case of Microsoft in the late 1990s serves as a pertinent example of antitrust intervention in the technology sector. The U.S. Department of Justice accused Microsoft of maintaining a monopoly in the personal computer operating systems market and engaging in anti-competitive practices to suppress rivals. Although the company was not ultimately broken up, the legal proceedings resulted in a settlement that imposed significant restrictions on Microsoft’s business practices. This case underscored the potential for regulatory bodies to impose structural changes on tech companies to ensure a level playing field.

In the context of Google, the company’s dominance in the search engine market has raised concerns about its ability to leverage its position to unfairly advantage its other products, such as the Chrome browser. Critics argue that Google’s integration of its search engine with Chrome creates barriers for competitors and limits consumer choice. This situation bears similarities to the Microsoft case, where the bundling of Internet Explorer with Windows was a central issue. Consequently, the possibility of Google being required to divest Chrome is not without precedent.

Moreover, the European Union has been at the forefront of antitrust actions against technology companies, often setting the stage for global regulatory trends. The EU’s decision to fine Google for anti-competitive practices related to its Android operating system highlights the willingness of regulators to take decisive action against perceived monopolistic behavior. Such actions reinforce the notion that tech giants must operate within a framework that promotes competition and prevents the abuse of market power.

As the legal landscape continues to evolve, the potential for Google to face a ruling that mandates the sale of Chrome underscores the importance of antitrust laws in maintaining competitive markets. While the specifics of any legal action remain uncertain, the historical precedents of AT&T and Microsoft provide valuable insights into how regulators might approach the issue. These cases illustrate the delicate balance between fostering innovation and preventing monopolistic practices, a balance that is crucial in the rapidly changing technology sector.

In conclusion, the possibility of Google being forced to divest its Chrome browser as a remedy for its search monopoly highlights the enduring relevance of antitrust laws. By examining past legal precedents, we gain a deeper understanding of the mechanisms available to regulators in addressing market dominance and ensuring fair competition. As technology continues to advance, the role of antitrust regulation will remain pivotal in shaping the future of the industry.

Consumer Implications Of A Google Chrome Sale

The potential divestiture of Google Chrome as a result of antitrust scrutiny could have significant implications for consumers, reshaping the digital landscape in ways that may alter how individuals interact with the internet. As regulatory bodies intensify their focus on curbing monopolistic practices, the prospect of Google being compelled to sell its Chrome browser emerges as a pivotal moment in the ongoing debate over market dominance and consumer choice. This development, while primarily aimed at addressing concerns over Google’s search monopoly, could inadvertently lead to a cascade of changes affecting user experience, privacy, and innovation.

To begin with, the sale of Chrome would likely introduce a new player into the browser market, potentially invigorating competition and fostering innovation. Currently, Chrome holds a substantial share of the browser market, a position that has allowed Google to integrate its search engine seamlessly into the browsing experience. By divesting Chrome, a new owner could emerge, one that might prioritize different features or business models, thereby offering consumers a broader array of choices. This increased competition could drive improvements in browser performance, security, and user-centric features, ultimately benefiting consumers who seek alternatives tailored to their specific needs.

Moreover, the separation of Chrome from Google’s ecosystem could have profound implications for user privacy. Google has long been scrutinized for its data collection practices, with Chrome serving as a conduit for gathering vast amounts of user information. A new owner might adopt a more privacy-focused approach, potentially reducing the extent of data tracking and offering users greater control over their personal information. This shift could align with the growing consumer demand for enhanced privacy protections, providing individuals with more transparent and secure browsing experiences.

In addition to privacy considerations, the divestiture of Chrome could influence the integration of services and applications within the browser. Currently, Chrome’s tight integration with Google’s suite of services, such as Gmail, Google Drive, and YouTube, offers users a seamless experience but also reinforces Google’s dominance across multiple digital domains. A new owner might choose to decouple these services, allowing for greater interoperability with third-party applications and fostering a more open and diverse digital ecosystem. This could empower consumers to customize their browsing experience, selecting services that best align with their preferences and needs.

However, it is important to acknowledge potential challenges that may arise from such a significant shift. The transition of Chrome to a new owner could lead to temporary disruptions in service continuity and support, as the new entity works to establish its infrastructure and operational capabilities. Consumers might experience changes in browser updates, security patches, and customer support, necessitating a period of adjustment. Additionally, the new owner would need to build trust with users, ensuring that the browser maintains its reputation for reliability and performance.

In conclusion, while the potential sale of Google Chrome in response to antitrust pressures presents a complex scenario, it also offers an opportunity to reshape the browser market in ways that could enhance consumer choice, privacy, and innovation. As the digital landscape continues to evolve, the implications of such a divestiture will undoubtedly be closely monitored by consumers, industry stakeholders, and regulators alike. Ultimately, the outcome of this development will hinge on the ability of the new owner to navigate the challenges and opportunities presented by this transformative moment in the tech industry.

The Future Of Google’s Search Monopoly Without Chrome

In the ever-evolving landscape of digital technology, the dominance of tech giants has become a focal point of regulatory scrutiny worldwide. Among these giants, Google stands out, particularly due to its commanding presence in the search engine market. However, recent developments suggest that Google might face significant changes to its business model, specifically concerning its Chrome browser. The possibility of Google being compelled to divest Chrome to mitigate its search monopoly has sparked widespread discussion about the future of its search dominance without the browser.

To understand the implications of such a move, it is essential to consider the symbiotic relationship between Google Search and Chrome. Chrome, as one of the most popular web browsers globally, serves as a crucial gateway for users accessing Google’s search engine. This integration has allowed Google to maintain a substantial share of the search market, as Chrome users are often directed to Google Search by default. Consequently, the potential separation of Chrome from Google’s portfolio could disrupt this seamless integration, thereby altering the dynamics of user access to Google’s search services.

Moreover, the divestiture of Chrome could lead to increased competition in the browser market. Currently, Chrome’s dominance has limited the growth of alternative browsers, which struggle to compete with its speed, user-friendly interface, and extensive ecosystem of extensions. If Chrome were to operate independently, it might be compelled to innovate and differentiate itself further to maintain its user base. This could, in turn, encourage other browsers to enhance their offerings, fostering a more competitive environment that benefits consumers through improved features and privacy protections.

In addition to affecting the browser market, the potential sale of Chrome could have broader implications for Google’s business strategy. Without the direct control of a leading browser, Google might need to explore new avenues to ensure its search engine remains the default choice for users. This could involve forging partnerships with other browser developers or investing in alternative technologies that enhance search capabilities. Such strategic shifts could redefine Google’s approach to maintaining its search market share, emphasizing innovation and collaboration over reliance on proprietary platforms.

Furthermore, the regulatory pressure on Google to divest Chrome underscores a growing global trend towards curbing the influence of tech monopolies. Governments and regulatory bodies are increasingly scrutinizing the practices of major technology companies, aiming to promote fair competition and protect consumer interests. The potential ruling against Google’s search monopoly could set a precedent for similar actions against other tech giants, signaling a shift towards a more balanced digital ecosystem.

In conclusion, the prospect of Google being forced to sell Chrome presents a pivotal moment in the tech industry, with far-reaching implications for the future of its search monopoly. While the divestiture could disrupt Google’s current business model, it also offers an opportunity for increased competition and innovation in both the browser and search markets. As regulatory bodies continue to challenge the dominance of tech giants, the industry may witness a transformation that prioritizes consumer choice and market fairness. Ultimately, the unfolding developments surrounding Google’s search monopoly and Chrome will be closely watched, as they hold the potential to reshape the digital landscape in profound ways.

Q&A

1. **What is the main issue regarding Google and its Chrome browser?**

Google is facing scrutiny over its dominance in the search engine market, and there are discussions about whether it should be forced to sell its Chrome browser to prevent a monopoly.

2. **Why is Google considered to have a monopoly in search?**

Google holds a significant market share in the search engine industry, which raises concerns about anti-competitive practices and the stifling of competition.

3. **What legal actions are being considered against Google?**

Regulators and lawmakers are considering antitrust actions that could potentially require Google to divest certain assets, such as its Chrome browser, to reduce its market dominance.

4. **How does Chrome contribute to Google’s search dominance?**

Chrome, being one of the most popular web browsers, directs a large volume of traffic to Google’s search engine, reinforcing its market position and contributing to its dominance.

5. **What are the potential consequences for Google if it is forced to sell Chrome?**

If Google is forced to sell Chrome, it could lose a significant channel for directing users to its search engine, potentially reducing its market share and advertising revenue.

6. **What are the broader implications of such a ruling for the tech industry?**

A ruling forcing Google to sell Chrome could set a precedent for increased regulatory scrutiny and antitrust actions against other tech giants, potentially reshaping the competitive landscape of the industry.The potential requirement for Google to sell Chrome to avoid a search monopoly ruling underscores the increasing regulatory scrutiny on tech giants and their market dominance. If enforced, such a divestiture could significantly alter the competitive landscape of the internet browser and search engine markets. It would likely encourage greater competition and innovation, potentially benefiting consumers with more choices and improved services. However, it could also pose challenges for Google in maintaining its integrated ecosystem strategy, which relies on the synergy between its browser and search engine. This move could set a precedent for future antitrust actions against other tech companies, signaling a shift towards more aggressive regulatory interventions in the tech industry.