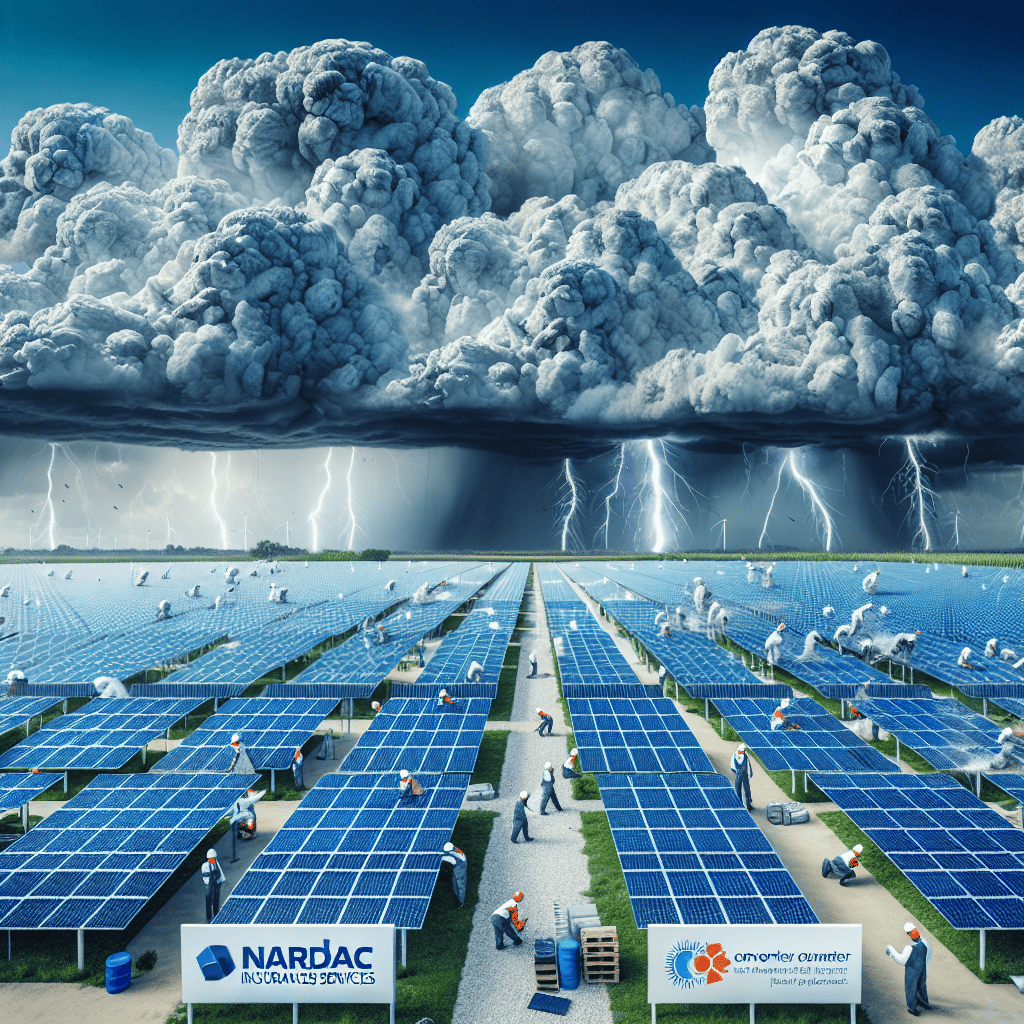

NARDAC Insurance Services has announced an expansion of its coverage offerings to include protection against convective storms for solar projects. This strategic enhancement aims to address the growing concerns of solar energy developers and investors regarding the potential risks posed by severe weather events, such as thunderstorms and tornadoes. By incorporating convective storm protection into their insurance policies, NARDAC seeks to provide comprehensive risk management solutions that safeguard solar investments, ensuring project viability and financial security in the face of unpredictable weather patterns. This move underscores NARDAC’s commitment to supporting the renewable energy sector and promoting the resilience of solar infrastructure.

NARDAC Insurance Services Expands Coverage Options

NARDAC Insurance Services has recently announced an expansion of its coverage options, a move that reflects the growing need for comprehensive risk management solutions in the renewable energy sector. As solar energy projects continue to proliferate across various regions, the potential for weather-related disruptions has become a significant concern for investors and developers alike. In response to this pressing issue, NARDAC has introduced convective storm protection specifically tailored for solar projects, thereby enhancing the resilience of these investments against unpredictable weather patterns.

Convective storms, characterized by their rapid development and intense weather phenomena, pose unique challenges to solar installations. These storms can bring about severe winds, hail, and heavy rainfall, all of which can lead to substantial damage to solar panels and associated infrastructure. Recognizing the vulnerabilities inherent in solar energy systems, NARDAC’s new coverage option aims to mitigate the financial risks associated with such weather events. By providing targeted protection, the company not only safeguards the physical assets but also ensures the continuity of energy production, which is vital for the economic viability of solar projects.

Moreover, this expansion of coverage options aligns with the broader trend of increasing investment in renewable energy. As governments and private entities commit to ambitious sustainability goals, the demand for reliable insurance solutions has surged. NARDAC’s proactive approach in addressing the specific risks faced by solar projects positions the company as a leader in the insurance market, catering to the evolving needs of its clients. This strategic move not only enhances NARDAC’s portfolio but also reinforces its commitment to supporting the growth of renewable energy initiatives.

In addition to the financial protection offered by convective storm coverage, NARDAC is also focused on providing clients with valuable resources and expertise. The company understands that effective risk management extends beyond insurance policies; it involves a comprehensive understanding of the environmental factors that can impact solar projects. To this end, NARDAC is dedicated to educating its clients about best practices in site selection, installation, and maintenance, which can significantly reduce the likelihood of damage from severe weather events.

Furthermore, the introduction of convective storm protection is indicative of NARDAC’s responsiveness to market demands. As climate change continues to influence weather patterns, the frequency and intensity of convective storms are expected to rise. By anticipating these changes and adapting its coverage options accordingly, NARDAC demonstrates a forward-thinking approach that is essential in today’s dynamic insurance landscape. This adaptability not only benefits current clients but also attracts new customers who are seeking reliable insurance solutions in an increasingly uncertain environment.

In conclusion, NARDAC Insurance Services’ expansion of coverage options to include convective storm protection for solar projects marks a significant advancement in the insurance industry. By addressing the specific risks associated with severe weather events, the company is not only enhancing the security of solar investments but also contributing to the overall growth of renewable energy. As the demand for sustainable energy solutions continues to rise, NARDAC’s commitment to providing comprehensive and tailored insurance products will undoubtedly play a crucial role in supporting the resilience and success of solar projects in the face of evolving environmental challenges.

Understanding Convective Storm Protection for Solar Projects

As the demand for renewable energy sources continues to rise, solar projects have become increasingly prevalent across various regions. However, these installations are not without their vulnerabilities, particularly when it comes to extreme weather events. Among the most significant threats to solar infrastructure are convective storms, which can produce severe weather phenomena such as thunderstorms, hail, and tornadoes. Understanding the implications of these storms is crucial for stakeholders in the solar industry, especially as NARDAC Insurance Services expands its coverage to include protection specifically tailored for such events.

Convective storms are characterized by the vertical development of clouds, which can lead to intense precipitation and strong winds. These storms often form in warm, moist air masses and can develop rapidly, posing a significant risk to solar panels and associated equipment. The impact of hail, for instance, can be particularly damaging, as it can cause physical damage to solar panels, leading to decreased efficiency or complete failure. Furthermore, high winds can dislodge panels or damage mounting systems, resulting in costly repairs and extended downtime for solar facilities.

In light of these risks, it is essential for solar project developers and operators to consider the potential financial implications of convective storms. The costs associated with repairing or replacing damaged equipment can be substantial, not to mention the loss of revenue during periods when the solar facility is non-operational. This is where specialized insurance coverage becomes invaluable. By expanding its offerings to include convective storm protection, NARDAC Insurance Services is addressing a critical gap in the market, providing solar project stakeholders with the peace of mind that comes from knowing they are protected against these unpredictable weather events.

Moreover, the inclusion of convective storm protection in insurance policies reflects a growing recognition of the need for tailored solutions in the renewable energy sector. As solar technology continues to evolve, so too do the risks associated with its deployment. Insurers must adapt to these changes by offering coverage that specifically addresses the unique challenges faced by solar projects. This proactive approach not only helps mitigate financial losses but also encourages further investment in renewable energy infrastructure, ultimately contributing to a more sustainable future.

In addition to financial protection, understanding the nature of convective storms can also inform better risk management practices for solar project operators. By analyzing historical weather data and identifying regions prone to severe convective storms, developers can make more informed decisions regarding site selection and design. For instance, choosing locations with lower storm frequency or implementing engineering solutions that enhance the resilience of solar installations can significantly reduce the likelihood of damage.

Furthermore, ongoing advancements in technology and materials science are paving the way for more robust solar panels and mounting systems that can withstand extreme weather conditions. As these innovations become more widely adopted, the overall risk profile of solar projects may improve, leading to lower insurance premiums and increased investor confidence.

In conclusion, the expansion of coverage to include convective storm protection by NARDAC Insurance Services represents a significant step forward in addressing the unique challenges faced by solar projects. By understanding the risks associated with convective storms and implementing tailored insurance solutions, stakeholders can better safeguard their investments and contribute to the continued growth of the renewable energy sector. As the industry evolves, so too will the strategies employed to mitigate risks, ensuring that solar energy remains a viable and sustainable option for the future.

Benefits of Enhanced Insurance Coverage for Solar Energy

The expansion of insurance coverage to include convective storm protection for solar projects represents a significant advancement in the realm of renewable energy risk management. As solar energy continues to gain traction as a sustainable alternative to fossil fuels, the need for comprehensive insurance solutions becomes increasingly critical. Enhanced insurance coverage not only safeguards investments but also fosters confidence among stakeholders, including investors, developers, and consumers. By addressing specific risks associated with solar energy projects, such as damage from severe weather events, this expanded coverage plays a pivotal role in promoting the growth of the solar industry.

One of the primary benefits of enhanced insurance coverage is the financial protection it offers against unpredictable weather patterns. Convective storms, characterized by their sudden onset and potential for severe impacts, pose a unique threat to solar installations. These storms can lead to significant property damage, operational downtime, and costly repairs. By incorporating protection against such events, insurance providers like NARDAC Insurance Services enable solar project developers to mitigate these risks effectively. This financial safety net not only protects the physical assets but also ensures that projects can continue to operate smoothly, thereby maintaining revenue streams.

Moreover, enhanced insurance coverage contributes to the overall stability of the solar energy market. As more developers and investors recognize the importance of comprehensive risk management, the availability of specialized insurance products can lead to increased investment in solar projects. This influx of capital is essential for the continued expansion of renewable energy infrastructure, which is crucial for meeting global energy demands and achieving sustainability goals. Consequently, as the solar industry grows, so too does the need for robust insurance solutions that can adapt to evolving risks.

In addition to financial protection and market stability, enhanced insurance coverage fosters innovation within the solar sector. With the assurance that their investments are protected against specific risks, developers are more likely to pursue cutting-edge technologies and innovative project designs. This willingness to embrace new ideas can lead to improved efficiency, reduced costs, and ultimately, a more resilient energy system. Furthermore, as the industry evolves, insurance providers can refine their offerings to better align with the unique challenges faced by solar projects, creating a dynamic relationship between risk management and technological advancement.

Another significant advantage of enhanced insurance coverage is the peace of mind it provides to stakeholders. Investors, developers, and consumers alike can feel more secure knowing that their interests are protected against unforeseen events. This sense of security can lead to increased participation in the solar market, as potential investors are more likely to commit resources when they are confident in the risk management strategies in place. Additionally, consumers may be more inclined to adopt solar energy solutions, knowing that the systems they invest in are backed by comprehensive insurance coverage.

In conclusion, the expansion of insurance coverage to include convective storm protection for solar projects offers numerous benefits that extend beyond mere financial protection. By addressing specific risks associated with solar energy, this enhanced coverage promotes market stability, encourages innovation, and provides peace of mind to stakeholders. As the solar industry continues to evolve, the importance of comprehensive insurance solutions will only grow, ensuring that renewable energy remains a viable and sustainable option for the future. Through initiatives like those undertaken by NARDAC Insurance Services, the solar sector can look forward to a more secure and prosperous future.

The Importance of Insuring Solar Projects Against Weather Risks

As the global shift towards renewable energy accelerates, solar projects have emerged as a cornerstone of sustainable development. However, the increasing prevalence of extreme weather events poses significant risks to these installations, making it imperative for stakeholders to consider comprehensive insurance solutions. The importance of insuring solar projects against weather risks cannot be overstated, as these risks can lead to substantial financial losses, operational disruptions, and even project failures.

Weather-related incidents, particularly convective storms, can have devastating effects on solar installations. These storms, characterized by their rapid development and intense conditions, can produce high winds, hail, and heavy rainfall, all of which can damage solar panels, inverters, and other critical components. For instance, hail can shatter solar panels, while strong winds can dislodge mounting systems, leading to costly repairs and extended downtimes. Consequently, the financial implications of such damage can be severe, affecting not only the immediate costs of repair but also the long-term viability of the project due to lost energy production.

Moreover, the unpredictability of weather patterns exacerbates the challenges faced by solar project developers and investors. Traditional risk assessments may not adequately account for the increasing frequency and intensity of convective storms, which are becoming more common due to climate change. As a result, stakeholders must adopt a proactive approach to risk management, which includes securing appropriate insurance coverage tailored to the unique vulnerabilities of solar projects. By doing so, they can mitigate potential losses and ensure the sustainability of their investments.

In light of these challenges, NARDAC Insurance Services has recognized the need for enhanced coverage options that specifically address the risks associated with convective storms. By expanding their offerings to include specialized protection for solar projects, NARDAC is responding to a critical gap in the market. This expansion not only reflects a growing awareness of the risks posed by extreme weather but also underscores the importance of innovative insurance solutions in safeguarding renewable energy investments.

Furthermore, the integration of convective storm protection into insurance policies for solar projects represents a significant advancement in risk management strategies. This coverage can provide financial security against the costs associated with storm damage, including repairs, replacement of equipment, and loss of revenue due to downtime. As a result, project developers and investors can focus on their core operations without the constant worry of unforeseen weather-related incidents derailing their efforts.

In addition to financial protection, insuring solar projects against weather risks fosters greater confidence among stakeholders. Investors are more likely to commit resources to projects that demonstrate a robust risk management framework, which includes comprehensive insurance coverage. This confidence can lead to increased funding opportunities and partnerships, ultimately driving the growth of the solar industry.

In conclusion, as the renewable energy sector continues to evolve, the importance of insuring solar projects against weather risks, particularly convective storms, cannot be overlooked. The expansion of coverage options by NARDAC Insurance Services is a timely and necessary response to the challenges posed by extreme weather events. By prioritizing risk management through specialized insurance solutions, stakeholders can protect their investments, ensure operational continuity, and contribute to the broader goal of sustainable energy development. As the industry moves forward, embracing such proactive measures will be essential in navigating the complexities of a changing climate and securing a resilient future for solar energy.

How NARDAC’s New Coverage Affects Solar Project Developers

NARDAC Insurance Services has recently expanded its coverage offerings to include convective storm protection specifically tailored for solar projects. This strategic move is poised to significantly impact solar project developers, who have long faced the challenges posed by unpredictable weather patterns. As the frequency and intensity of convective storms, which include thunderstorms, hail, and tornadoes, continue to rise due to climate change, the need for comprehensive insurance solutions has never been more pressing. By introducing this new coverage, NARDAC aims to provide solar developers with the peace of mind necessary to invest in and expand their renewable energy initiatives.

The introduction of convective storm protection is particularly relevant for solar project developers, as these storms can cause substantial damage to solar panels and associated infrastructure. For instance, hail can shatter solar panels, while high winds can dislodge mounting systems, leading to costly repairs and extended downtimes. Consequently, the financial implications of such weather events can be detrimental to project viability and profitability. With NARDAC’s new coverage, developers can now mitigate these risks more effectively, allowing them to focus on project execution rather than potential weather-related setbacks.

Moreover, this expanded coverage aligns with the growing trend of integrating risk management strategies into the planning phases of solar projects. Developers are increasingly recognizing that comprehensive insurance is not merely an afterthought but a critical component of project feasibility. By securing convective storm protection, developers can enhance their project proposals, making them more attractive to investors and stakeholders who prioritize risk mitigation. This proactive approach not only safeguards their investments but also contributes to the overall stability of the renewable energy sector.

In addition to financial protection, NARDAC’s new coverage fosters a culture of resilience within the solar industry. As developers become more aware of the potential impacts of convective storms, they are likely to adopt more robust design and engineering practices. This could lead to the implementation of advanced technologies and materials that enhance the durability of solar installations. Consequently, the industry may witness a shift towards more resilient solar projects that can withstand extreme weather events, ultimately contributing to the sustainability of renewable energy sources.

Furthermore, the availability of convective storm protection may encourage more developers to enter the solar market. With the assurance that their investments are safeguarded against severe weather, new players may feel more confident in pursuing solar projects. This influx of developers could lead to increased competition, driving innovation and efficiency within the sector. As a result, the overall growth of the solar industry may accelerate, further contributing to the global transition towards renewable energy.

In conclusion, NARDAC Insurance Services’ expansion of coverage to include convective storm protection represents a significant advancement for solar project developers. By addressing the specific risks associated with convective storms, this new insurance offering not only enhances financial security but also promotes a culture of resilience and innovation within the industry. As solar developers embrace these protective measures, they are likely to experience greater confidence in their projects, ultimately leading to a more robust and sustainable renewable energy landscape. The implications of this coverage extend beyond individual projects, potentially shaping the future of solar energy development in a rapidly changing climate.

Future Trends in Insurance for Renewable Energy Projects

As the renewable energy sector continues to evolve, the insurance landscape is adapting to meet the unique challenges and risks associated with these projects. One notable trend is the increasing recognition of the need for specialized coverage that addresses the specific vulnerabilities of renewable energy installations, particularly solar projects. With the expansion of NARDAC Insurance Services to include convective storm protection, the industry is witnessing a significant shift towards more comprehensive risk management solutions tailored to the nuances of renewable energy.

The growing prevalence of extreme weather events, driven by climate change, has underscored the importance of robust insurance coverage for solar projects. Convective storms, characterized by their sudden onset and potential for severe damage, pose a particular threat to solar installations. These storms can lead to hail damage, high winds, and flooding, all of which can severely impact the operational efficiency and financial viability of solar energy systems. As a result, insurers are increasingly focusing on developing policies that specifically address these risks, ensuring that solar project developers and operators are adequately protected.

Moreover, the expansion of coverage options reflects a broader trend within the insurance industry to embrace innovation and adapt to the changing landscape of renewable energy. Insurers are leveraging advanced data analytics and modeling techniques to better understand the risks associated with renewable energy projects. By analyzing historical weather patterns and utilizing predictive modeling, insurance providers can offer more accurate assessments of risk and tailor their policies accordingly. This data-driven approach not only enhances the precision of risk evaluation but also fosters a more proactive stance in managing potential losses.

In addition to addressing specific weather-related risks, the insurance industry is also recognizing the importance of sustainability and environmental responsibility. As more companies commit to reducing their carbon footprints and investing in renewable energy, insurers are beginning to offer incentives for projects that demonstrate a commitment to sustainable practices. This trend is likely to encourage further investment in renewable energy, as project developers can benefit from lower premiums and enhanced coverage options when they prioritize sustainability in their operations.

Furthermore, as the renewable energy sector matures, there is a growing emphasis on collaboration between insurers, project developers, and other stakeholders. This collaborative approach is essential for identifying emerging risks and developing comprehensive insurance solutions that address the evolving needs of the industry. By fostering open communication and sharing insights, stakeholders can work together to create a more resilient insurance framework that supports the growth of renewable energy projects.

As NARDAC Insurance Services expands its offerings to include convective storm protection, it sets a precedent for other insurers to follow suit. This move not only highlights the importance of specialized coverage in the renewable energy sector but also signals a shift towards a more nuanced understanding of the risks involved. As the industry continues to adapt to the realities of climate change and extreme weather, it is likely that we will see further innovations in insurance products designed specifically for renewable energy projects.

In conclusion, the future of insurance for renewable energy projects is poised for transformation, driven by the need for specialized coverage, data-driven risk assessment, and a commitment to sustainability. As insurers like NARDAC Insurance Services lead the way in expanding coverage options, the renewable energy sector can look forward to a more secure and resilient future, enabling continued growth and innovation in this vital industry.

Q&A

1. **What is NARDAC Insurance Services?**

NARDAC Insurance Services is a provider of specialized insurance solutions, focusing on coverage for renewable energy projects, including solar installations.

2. **What new coverage has NARDAC Insurance Services introduced?**

NARDAC Insurance Services has expanded its coverage to include protection against convective storms for solar projects.

3. **What are convective storms?**

Convective storms are weather events characterized by the vertical development of clouds, often leading to thunderstorms, heavy rain, hail, and strong winds.

4. **Why is convective storm protection important for solar projects?**

Convective storm protection is crucial for solar projects as these storms can cause significant damage to solar panels and infrastructure, impacting energy production and financial stability.

5. **How does this expanded coverage benefit solar project developers?**

The expanded coverage provides peace of mind to solar project developers by mitigating financial risks associated with storm damage, ensuring project viability and investment security.

6. **Are there any specific conditions or limitations associated with this coverage?**

Specific conditions and limitations may apply, and it is advisable for project developers to review the policy details with NARDAC Insurance Services to understand the extent of coverage and any exclusions.NARDAC Insurance Services’ expansion of coverage to include convective storm protection for solar projects signifies a proactive approach to addressing the unique risks associated with renewable energy infrastructure. This enhancement not only provides greater security for solar project developers and investors but also promotes the growth of the solar industry by mitigating potential financial losses from severe weather events. Overall, this move reflects a commitment to supporting sustainable energy solutions while ensuring comprehensive risk management in an evolving climate landscape.