In recent years, Indian banks have increasingly recognized the need to adopt innovative strategies to combat the rising threat of fraud. With the rapid digitization of financial services and the growing sophistication of cybercriminals, traditional methods of fraud detection and prevention are no longer sufficient. As a result, banks are implementing advanced technologies such as artificial intelligence, machine learning, and blockchain to enhance their security frameworks. Additionally, they are focusing on improving customer awareness and collaboration with regulatory bodies to create a more robust defense against fraudulent activities. This proactive approach not only aims to protect financial assets but also to maintain customer trust and ensure the stability of the banking sector in India.

Innovative Technologies in Fraud Detection

In recent years, Indian banks have increasingly recognized the need to enhance their fraud detection capabilities, leading to the adoption of innovative technologies that promise to revolutionize the way financial institutions combat fraudulent activities. As the banking sector grapples with the complexities of digital transactions and the growing sophistication of cybercriminals, the integration of advanced technologies has become imperative. One of the most significant advancements in this realm is the implementation of artificial intelligence (AI) and machine learning (ML) algorithms. These technologies enable banks to analyze vast amounts of transaction data in real time, identifying patterns and anomalies that may indicate fraudulent behavior. By leveraging AI and ML, banks can not only detect fraud more efficiently but also reduce false positives, thereby minimizing disruptions to legitimate customers.

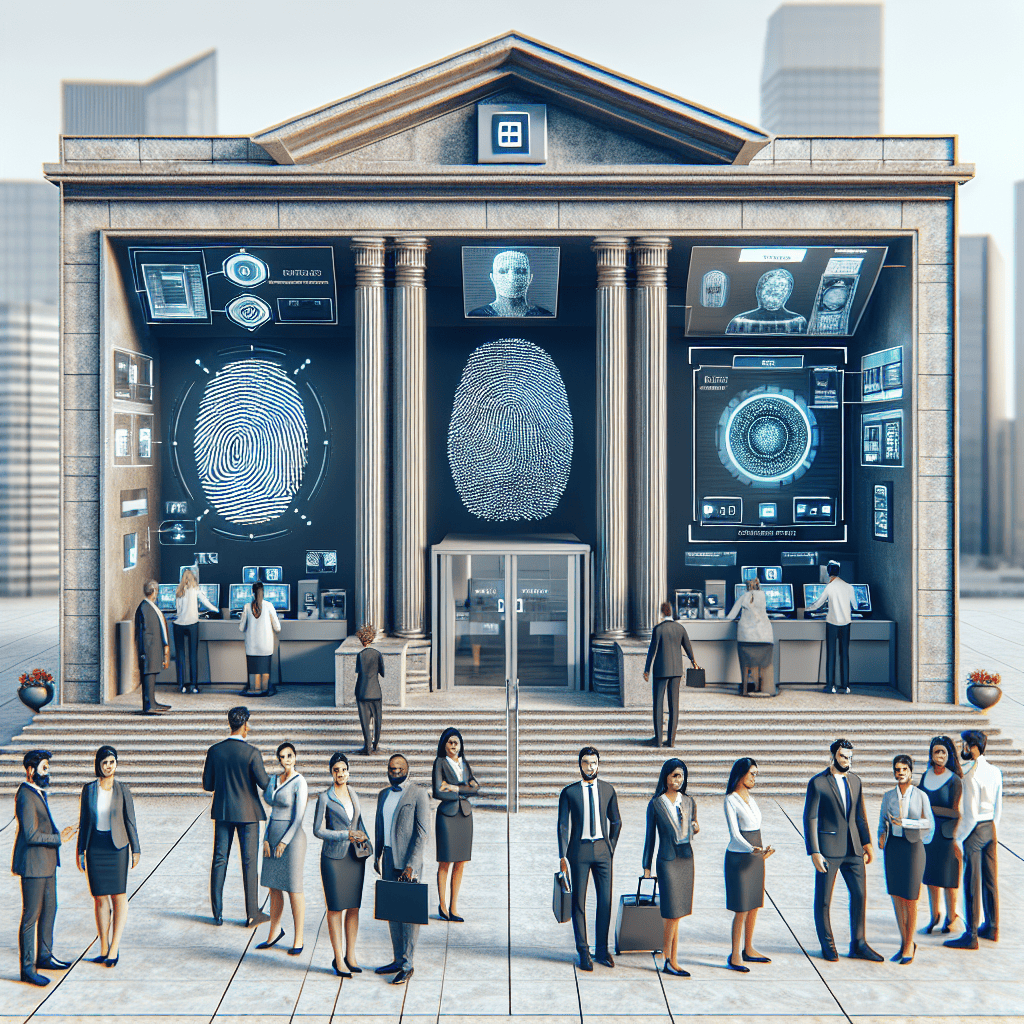

Moreover, the use of biometric authentication has gained traction as a robust method for enhancing security. Fingerprint recognition, facial recognition, and iris scanning are becoming commonplace in banking applications, providing an additional layer of protection against unauthorized access. This shift towards biometric solutions is particularly relevant in a country like India, where mobile banking is on the rise. By ensuring that only authorized users can access sensitive financial information, banks can significantly mitigate the risk of identity theft and account takeover, which are prevalent forms of fraud.

In addition to AI and biometric technologies, blockchain has emerged as a transformative force in the fight against fraud. The decentralized nature of blockchain technology ensures that all transactions are recorded in a secure and immutable ledger, making it exceedingly difficult for fraudsters to manipulate data. Indian banks are beginning to explore the potential of blockchain not only for enhancing transaction security but also for improving transparency in various banking processes. By adopting blockchain, banks can create a more trustworthy environment for their customers, thereby fostering greater confidence in digital banking services.

Furthermore, the implementation of advanced analytics tools has become essential for banks aiming to stay ahead of fraudsters. These tools allow financial institutions to conduct comprehensive risk assessments and monitor transactions for suspicious activities. By employing predictive analytics, banks can anticipate potential fraud scenarios and take proactive measures to prevent them. This forward-thinking approach not only protects the bank’s assets but also safeguards customers’ interests, reinforcing the institution’s commitment to security.

As Indian banks continue to embrace these innovative technologies, collaboration with fintech companies has also emerged as a key strategy. By partnering with agile and tech-savvy startups, traditional banks can leverage cutting-edge solutions that enhance their fraud detection capabilities. This collaboration fosters a culture of innovation, enabling banks to stay abreast of the latest developments in technology and adapt their strategies accordingly. Such partnerships are particularly beneficial in a rapidly evolving digital landscape, where the threat of fraud is ever-present.

In conclusion, the integration of innovative technologies in fraud detection represents a significant shift in the approach taken by Indian banks. By harnessing the power of AI, biometric authentication, blockchain, and advanced analytics, financial institutions are better equipped to combat fraud and protect their customers. As these technologies continue to evolve, it is crucial for banks to remain vigilant and adaptable, ensuring that they can effectively respond to emerging threats in the dynamic world of digital finance. Ultimately, the commitment to embracing innovation will not only enhance security but also contribute to the overall growth and stability of the banking sector in India.

Strengthening Cybersecurity Measures

In recent years, the banking sector in India has witnessed a significant surge in cyber fraud, prompting financial institutions to adopt more robust cybersecurity measures. As the digital landscape evolves, so too do the tactics employed by cybercriminals, necessitating a proactive approach from banks to safeguard their assets and customer information. Recognizing the critical importance of cybersecurity, Indian banks are increasingly investing in advanced technologies and strategies designed to fortify their defenses against potential threats.

One of the primary strategies being implemented is the enhancement of threat detection systems. By leveraging artificial intelligence and machine learning, banks can analyze vast amounts of data in real-time, identifying unusual patterns that may indicate fraudulent activity. This proactive monitoring allows institutions to respond swiftly to potential breaches, minimizing the risk of financial loss and reputational damage. Furthermore, these technologies enable banks to continuously learn from past incidents, refining their algorithms to improve future detection capabilities.

In addition to advanced analytics, Indian banks are also focusing on employee training and awareness programs. Recognizing that human error is often a significant factor in successful cyberattacks, financial institutions are investing in comprehensive training initiatives aimed at educating staff about the latest cybersecurity threats and best practices. By fostering a culture of vigilance and responsibility, banks can empower their employees to recognize and report suspicious activities, thereby creating an additional layer of security.

Moreover, collaboration among banks and regulatory bodies has become increasingly vital in the fight against cyber fraud. By sharing information about emerging threats and vulnerabilities, financial institutions can collectively strengthen their defenses. Initiatives such as the establishment of industry-wide cybersecurity frameworks and the creation of information-sharing platforms facilitate a more coordinated response to cyber threats. This collaborative approach not only enhances individual bank security but also contributes to the overall resilience of the banking sector as a whole.

Another critical aspect of strengthening cybersecurity measures is the implementation of multi-factor authentication (MFA). By requiring customers to provide multiple forms of verification before accessing their accounts, banks can significantly reduce the likelihood of unauthorized access. This added layer of security is particularly important in an era where phishing attacks and credential theft are prevalent. As customers become more aware of the importance of safeguarding their personal information, banks are also encouraged to promote the use of MFA as a standard practice.

Furthermore, regulatory compliance plays a crucial role in shaping the cybersecurity strategies of Indian banks. The Reserve Bank of India (RBI) has established stringent guidelines aimed at enhancing the security posture of financial institutions. By adhering to these regulations, banks not only mitigate the risk of cyber fraud but also build trust with their customers. Compliance with these standards ensures that banks are equipped with the necessary tools and protocols to respond effectively to cyber threats.

In conclusion, as cyber fraud continues to pose a significant challenge to the Indian banking sector, financial institutions are embracing new strategies to bolster their cybersecurity measures. Through the integration of advanced technologies, employee training, collaborative efforts, and regulatory compliance, banks are taking decisive steps to protect their assets and maintain customer trust. As the landscape of cyber threats evolves, the commitment to strengthening cybersecurity will remain a top priority for Indian banks, ensuring that they are well-equipped to navigate the complexities of the digital age.

Employee Training and Awareness Programs

In recent years, the banking sector in India has witnessed a significant rise in fraudulent activities, prompting financial institutions to adopt innovative strategies to combat this growing threat. One of the most effective approaches has been the implementation of comprehensive employee training and awareness programs. These initiatives are designed to equip bank staff with the necessary skills and knowledge to identify, prevent, and respond to fraudulent activities, thereby fostering a culture of vigilance and accountability within the organization.

To begin with, the importance of employee training cannot be overstated. Employees are often the first line of defense against fraud, and their ability to recognize suspicious behavior or transactions is crucial. Consequently, banks have begun to invest heavily in tailored training programs that address the specific types of fraud prevalent in the industry. These programs typically cover a range of topics, including the latest fraud schemes, regulatory compliance, and the use of technology in fraud detection. By providing employees with up-to-date information, banks can ensure that their staff remains vigilant and informed about emerging threats.

Moreover, these training programs are not limited to new hires; they are designed to be ongoing, reflecting the dynamic nature of fraud. Regular refresher courses and workshops help reinforce the knowledge gained during initial training sessions, ensuring that employees remain aware of the latest trends and tactics employed by fraudsters. This continuous education is essential, as it helps to create a workforce that is not only knowledgeable but also proactive in its approach to fraud prevention.

In addition to formal training sessions, banks are increasingly utilizing technology to enhance employee awareness. E-learning platforms and interactive modules allow staff to engage with the material at their own pace, making it easier to absorb complex information. Furthermore, these digital tools often include real-life case studies and simulations that provide employees with practical experience in identifying and responding to fraudulent activities. By incorporating technology into training programs, banks can create a more engaging and effective learning environment.

Another critical aspect of these awareness programs is the emphasis on fostering a culture of open communication within the organization. Employees are encouraged to report any suspicious activities or concerns without fear of retribution. This open-door policy not only empowers staff but also promotes a sense of collective responsibility in combating fraud. When employees feel supported and valued, they are more likely to take an active role in safeguarding the institution against potential threats.

Additionally, collaboration between different departments within the bank is essential for effective fraud prevention. Training programs often include cross-departmental workshops that bring together employees from various functions, such as operations, compliance, and risk management. This collaborative approach ensures that all staff members understand their role in the broader context of fraud prevention and can work together to identify and mitigate risks.

In conclusion, as Indian banks continue to face the challenges posed by fraud, the implementation of robust employee training and awareness programs has emerged as a vital strategy. By investing in the education and empowerment of their staff, banks can create a proactive workforce that is well-equipped to detect and prevent fraudulent activities. This commitment to ongoing training not only enhances the bank’s overall security posture but also fosters a culture of vigilance and accountability that is essential in today’s rapidly evolving financial landscape. Ultimately, the success of these initiatives will play a crucial role in safeguarding the integrity of the banking sector and maintaining customer trust.

Collaboration with Law Enforcement Agencies

In recent years, Indian banks have increasingly recognized the critical need to enhance their strategies for combating fraud, leading to a significant shift in their approach. One of the most effective strategies that has emerged is the collaboration with law enforcement agencies. This partnership is not merely a reactive measure; rather, it represents a proactive stance aimed at creating a robust framework for fraud prevention and detection. By working closely with law enforcement, banks can leverage the expertise and resources of these agencies, thereby strengthening their overall security posture.

The collaboration between banks and law enforcement agencies is multifaceted. It encompasses information sharing, joint training programs, and the establishment of dedicated task forces. For instance, banks are now more inclined to share data related to suspicious transactions with law enforcement, which can facilitate quicker investigations and lead to the identification of fraudsters. This exchange of information is crucial, as it allows both parties to stay ahead of emerging fraud trends and adapt their strategies accordingly. Furthermore, by analyzing patterns in fraudulent activities, banks can implement more effective preventive measures, thereby reducing the incidence of fraud.

In addition to information sharing, joint training programs have become a cornerstone of this collaboration. These programs are designed to educate bank employees about the latest fraud schemes and the best practices for identifying and reporting suspicious activities. Law enforcement agencies bring their expertise in criminal investigation and cybercrime, which enriches the training experience for bank staff. As a result, employees are better equipped to recognize red flags and respond appropriately, ultimately leading to a more vigilant banking environment.

Moreover, the establishment of dedicated task forces has proven to be an effective strategy in addressing fraud. These task forces typically consist of representatives from both the banking sector and law enforcement agencies, working together to investigate complex fraud cases. By pooling their resources and expertise, these teams can conduct thorough investigations that may have been challenging for either party to undertake alone. This collaborative approach not only enhances the chances of apprehending fraudsters but also serves as a deterrent to potential criminals who may think twice before engaging in fraudulent activities.

The benefits of this collaboration extend beyond immediate fraud detection and prevention. By fostering a strong relationship with law enforcement, banks can contribute to the development of more comprehensive regulatory frameworks that address the evolving nature of financial crimes. This collaborative effort can lead to the formulation of policies that not only protect consumers but also promote a safer banking environment overall. As banks and law enforcement agencies continue to work together, they can create a unified front against fraud, which is essential in today’s increasingly digital landscape.

In conclusion, the collaboration between Indian banks and law enforcement agencies represents a significant advancement in the fight against fraud. By sharing information, conducting joint training programs, and establishing dedicated task forces, both parties can enhance their capabilities and respond more effectively to fraudulent activities. This partnership not only improves the immediate response to fraud but also contributes to the long-term development of a more secure banking environment. As the landscape of financial crime continues to evolve, such collaborations will be vital in ensuring that banks remain resilient and capable of protecting their customers from the ever-present threat of fraud.

Implementation of AI and Machine Learning

In recent years, Indian banks have increasingly recognized the necessity of adopting advanced technologies to combat the growing threat of fraud. Among the most significant developments in this arena is the implementation of artificial intelligence (AI) and machine learning (ML) systems. These technologies are transforming the way financial institutions detect, prevent, and respond to fraudulent activities, thereby enhancing their overall security frameworks. As the banking sector grapples with sophisticated fraud schemes, the integration of AI and ML has emerged as a pivotal strategy.

To begin with, AI and ML algorithms are adept at analyzing vast amounts of data in real time, which is crucial in identifying patterns that may indicate fraudulent behavior. Traditional methods of fraud detection often rely on static rules and historical data, which can be insufficient in the face of evolving tactics employed by fraudsters. In contrast, AI-driven systems can learn from new data continuously, adapting their models to recognize emerging threats. This dynamic capability allows banks to stay one step ahead of fraudsters, significantly reducing the likelihood of successful fraudulent transactions.

Moreover, the implementation of AI and ML facilitates the automation of fraud detection processes. By employing these technologies, banks can streamline their operations, allowing for quicker responses to suspicious activities. For instance, when a transaction triggers an alert, AI systems can automatically assess the risk level based on a multitude of factors, such as transaction history, customer behavior, and geographical location. This not only expedites the decision-making process but also minimizes the burden on human analysts, who can then focus on more complex cases that require nuanced judgment.

In addition to enhancing detection capabilities, AI and ML also play a crucial role in improving customer experience. Fraud prevention measures often involve additional verification steps that can frustrate customers. However, with the implementation of intelligent systems, banks can strike a balance between security and convenience. For example, AI can analyze a customer’s transaction patterns and determine when to apply additional scrutiny. This targeted approach reduces unnecessary friction for legitimate transactions while still maintaining robust security measures.

Furthermore, the collaboration between banks and technology firms has accelerated the development of innovative solutions tailored to the unique challenges of the Indian banking landscape. By leveraging the expertise of tech companies specializing in AI and ML, banks can access cutting-edge tools and methodologies that enhance their fraud detection capabilities. This partnership not only fosters innovation but also ensures that financial institutions remain agile in adapting to new threats.

As Indian banks continue to embrace AI and ML, they are also mindful of the ethical implications associated with these technologies. Ensuring data privacy and compliance with regulatory standards is paramount. Consequently, banks are investing in frameworks that govern the ethical use of AI, ensuring that customer data is handled responsibly while still harnessing the power of these advanced technologies.

In conclusion, the implementation of AI and machine learning in Indian banks represents a significant advancement in the fight against fraud. By leveraging these technologies, financial institutions can enhance their detection capabilities, streamline operations, and improve customer experiences. As the banking sector evolves, the ongoing collaboration between banks and technology firms will be essential in developing innovative solutions that address the ever-changing landscape of fraud. Ultimately, the strategic adoption of AI and ML not only fortifies the security of Indian banks but also instills greater confidence among customers, fostering a more secure financial environment.

Customer Education on Fraud Prevention

In recent years, the rise of digital banking has transformed the financial landscape in India, offering unprecedented convenience and accessibility to millions of customers. However, this shift has also brought about an increase in fraudulent activities, prompting Indian banks to adopt innovative strategies to combat these threats. One of the most effective approaches that banks are now implementing is customer education on fraud prevention. By empowering customers with knowledge and awareness, banks aim to create a more secure banking environment.

To begin with, it is essential to recognize that many customers may not fully understand the various types of fraud that can occur in the digital space. Phishing scams, identity theft, and unauthorized transactions are just a few examples of the threats that individuals face. Consequently, banks are taking proactive measures to educate their customers about these risks. Through informative campaigns, banks are disseminating crucial information about how to identify potential scams and the steps to take if they suspect fraudulent activity. This educational outreach is often conducted through multiple channels, including social media, email newsletters, and in-branch workshops, ensuring that the message reaches a broad audience.

Moreover, banks are increasingly utilizing technology to enhance their educational efforts. For instance, many institutions have developed mobile applications that not only facilitate banking transactions but also include features dedicated to fraud awareness. These applications often provide real-time alerts about suspicious activities, as well as tips on how to safeguard personal information. By integrating educational resources into everyday banking tools, banks are making it easier for customers to stay informed and vigilant.

In addition to technology-driven initiatives, banks are also focusing on personalized communication to enhance customer education. By analyzing customer behavior and transaction patterns, banks can tailor their messages to address specific vulnerabilities. For example, if a customer frequently travels abroad, the bank may provide targeted advice on how to protect their accounts while overseas. This personalized approach not only increases the relevance of the information but also fosters a sense of trust and partnership between the bank and its customers.

Furthermore, collaboration with regulatory bodies and law enforcement agencies plays a crucial role in the fight against fraud. Banks are working closely with these entities to develop comprehensive educational programs that inform customers about the latest fraud trends and prevention techniques. By sharing insights and resources, banks can create a unified front against fraudsters, ultimately benefiting the entire financial ecosystem.

As customer education initiatives gain momentum, it is important to measure their effectiveness. Banks are increasingly employing feedback mechanisms to assess the impact of their educational campaigns. Surveys and focus groups allow banks to gather valuable insights into customer awareness levels and identify areas for improvement. This iterative process ensures that educational efforts remain relevant and effective in addressing the evolving landscape of fraud.

In conclusion, as Indian banks continue to embrace new strategies to tackle fraud, customer education on fraud prevention stands out as a vital component of their approach. By equipping customers with the knowledge and tools necessary to recognize and respond to fraudulent activities, banks are not only protecting their clients but also enhancing their overall reputation. As the financial sector evolves, the commitment to customer education will undoubtedly play a pivotal role in fostering a secure and resilient banking environment for all.

Q&A

1. **What new strategies are Indian banks implementing to tackle fraud?**

Indian banks are adopting advanced technologies such as artificial intelligence, machine learning, and blockchain to enhance fraud detection and prevention.

2. **How are banks using AI in fraud detection?**

Banks are utilizing AI algorithms to analyze transaction patterns in real-time, identifying anomalies that may indicate fraudulent activity.

3. **What role does customer education play in preventing fraud?**

Customer education initiatives are being launched to raise awareness about common fraud schemes and promote safe banking practices among users.

4. **How are banks collaborating with law enforcement?**

Banks are forming partnerships with law enforcement agencies to share data and insights, improving the response to and investigation of fraud cases.

5. **What measures are being taken to secure digital transactions?**

Enhanced security protocols, such as two-factor authentication and biometric verification, are being implemented to protect digital transactions from fraud.

6. **How are regulatory bodies influencing banks’ anti-fraud strategies?**

Regulatory bodies are setting stricter compliance requirements and guidelines, prompting banks to adopt more robust anti-fraud measures and reporting systems.Indian banks are increasingly adopting innovative strategies to combat fraud, leveraging advanced technologies such as artificial intelligence, machine learning, and data analytics. By enhancing their risk assessment frameworks, implementing real-time monitoring systems, and fostering a culture of cybersecurity awareness, these institutions are better equipped to detect and prevent fraudulent activities. Collaborative efforts with regulatory bodies and the sharing of intelligence among banks further strengthen their defenses. As a result, the proactive measures being implemented not only protect financial assets but also bolster customer trust and confidence in the banking system. Overall, the shift towards a more robust and technology-driven approach signifies a critical evolution in the fight against fraud in the Indian banking sector.